Checklist Series, Part 8: The Industry Advantage (plus charts!)

For what it’s worth, the Checklist Series is not resonating with readers. These pieces have the lowest open rates of any newsletters I send out. Too technical? Too boring? Should I go back to shit-talking mutual fund salespeople and writing about my pipe tobacco smoking habits (the single topic I have had the most feedback on, by far, for some strange reason)?

Well, I’m committed to seeing this through. I’ll try my best to keep this (and future) editions as snappy as possible. And as a reward for those who stick around, I’ll highlight some of my favourite charts from the past couple of weeks at the end. I’m seeing some worrying patterns appearing.

Today, we discuss the importance of understanding industry dynamics.

An important part of analyzing a company is understanding how the industry it lives in operates. This isn’t just about comparing it to today’s competition; rather, it’s about understanding the trends that will drive future competitiveness.

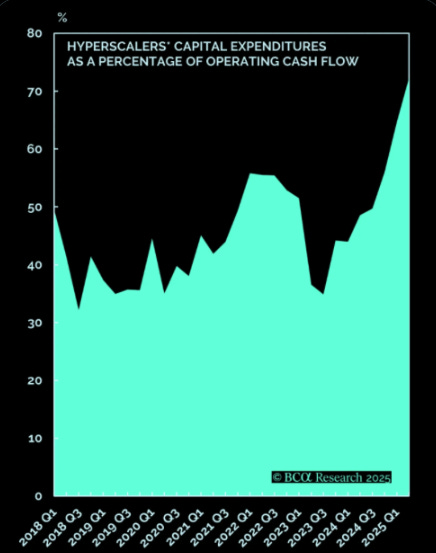

Many businesses benefit from scale, but only if the industry lends itself to that. Look at the “hyperscalers,” the large global tech behemoths that dominate cloud computing. Data centres and computing power are expensive, so it wouldn’t make sense to duplicate these efforts unnecessarily. We need enough global networks to provide competition, but not so many that we would end up with a massive data centre on every block.

At the other extreme, there is no benefit to my local cobbler being part of an international conglomerate of shoe repair shops. This industry is hyper-local. Find me someone who can repair my shoes a short walk from my office, and they will get my business. Bonus points if the repair can be done over lunch while I’m across the street eating an Extra Value Meal.

In the context of a “low risk” framework, understanding the industry dynamics allows us to think about which companies have the current at their backs, and which are likely to struggle swimming upstream.

If it’s an industry with scale advantages, a smaller secondary player could have a hard time, unless it serves a distinct niche.

If it’s a hyper-competitive industry, we look for some of the other checklist items in order to understand what competitive advantages our potential investment may or may not possess.

Are there limits to the market size? Does my neighbourhood need another coffee shop (probably not) or cannabis shop1 (definitely not!)

Conversely, are there significant barriers to entry that would discourage potential new entrants (maybe high capital requirements, or regulatory restrictions)? Have we seen evidence of new competitors entering the market, and failing? If so, what did they do wrong? Are other potential competitors better positioned?

There are many angles to look at here, and this would be too long a piece to cover them all (and apparently, very few are reading them anyway… 😐.) So I’ll leave it at that. In examining a potential investment, spend a good amount of time studying the industry in which it operates.

Chart-o-Rama

As promised… a bonus for those of you who ate your vegetables.

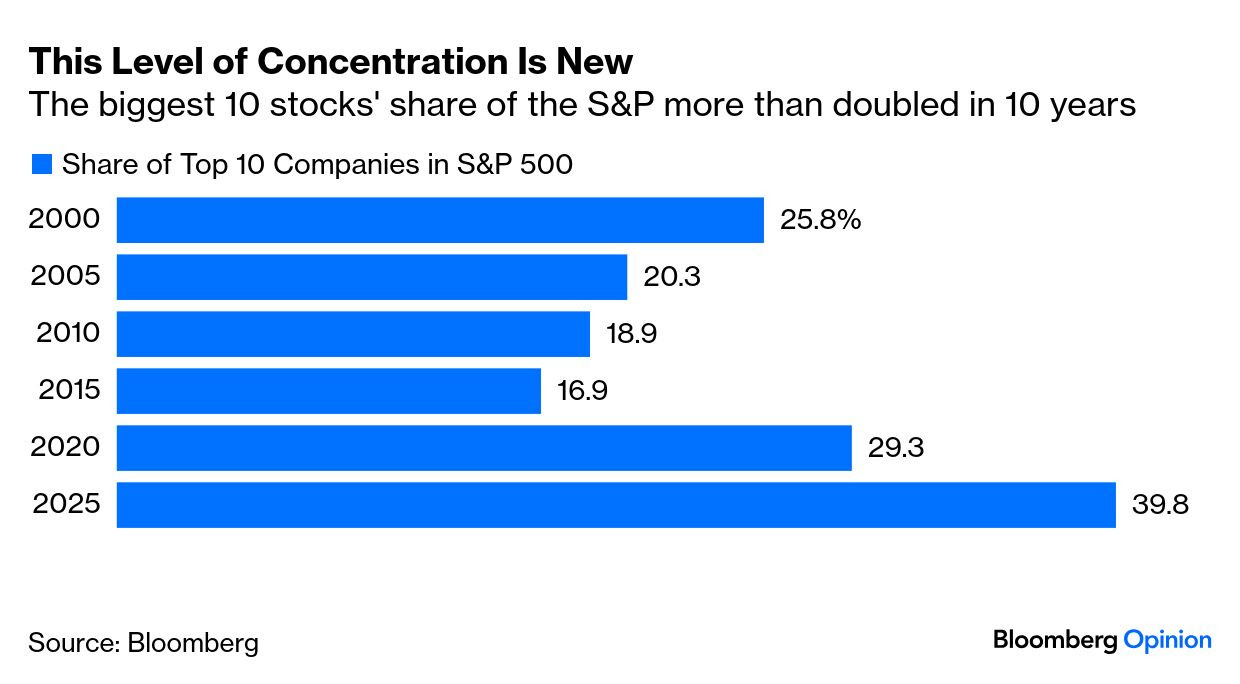

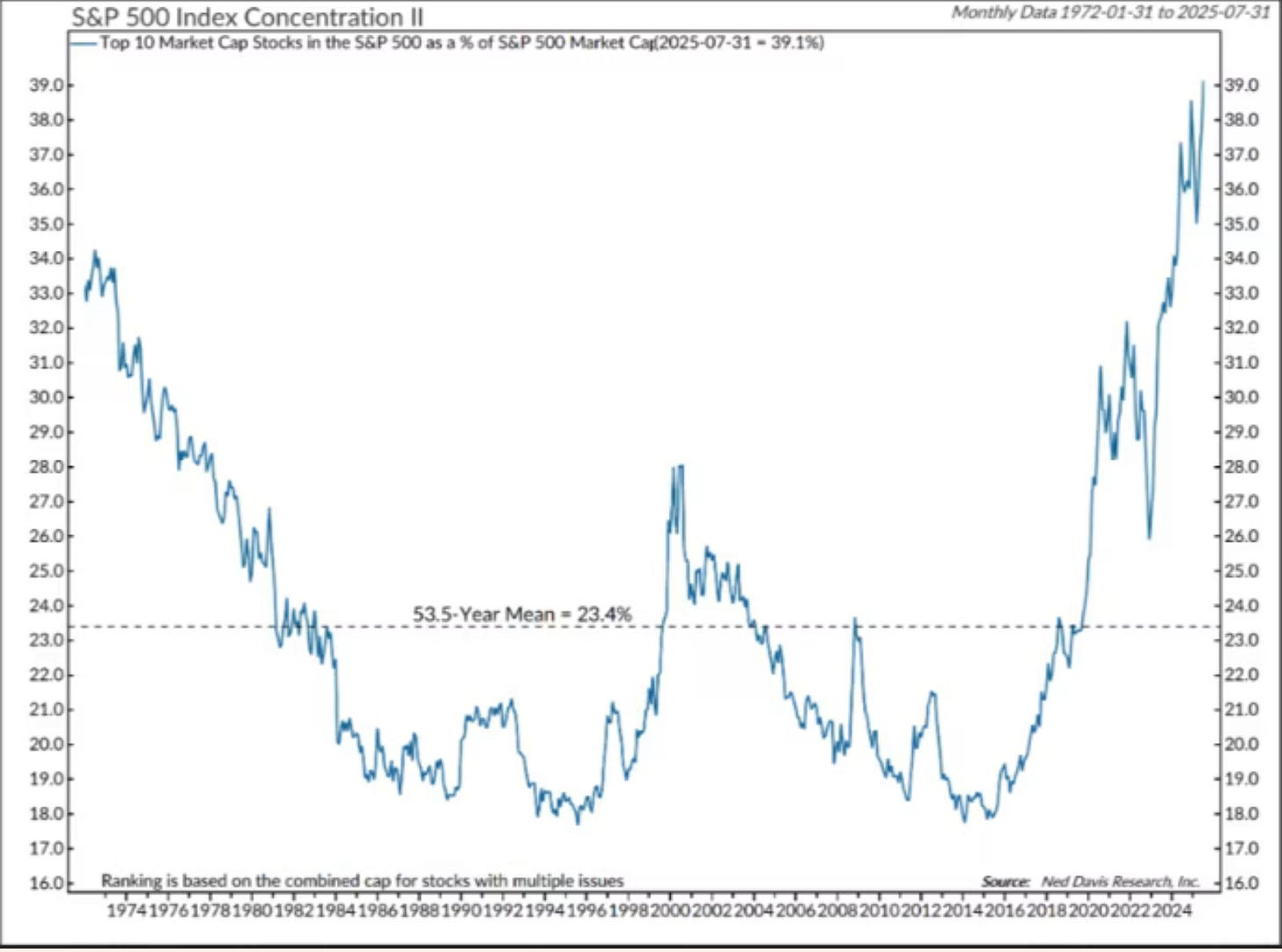

Index concentration is getting silly. The S&P 500 is getting shittier.

Exhibit A:

Exhibit B (this visual is wild):

While this is happening, the largest companies are spending more and more of their profits on capital investments. One of the selling features of these investments was that they were “capital light” businesses. They aren’t any longer. This is a dramatic change in what it means to be an owner of these businesses.

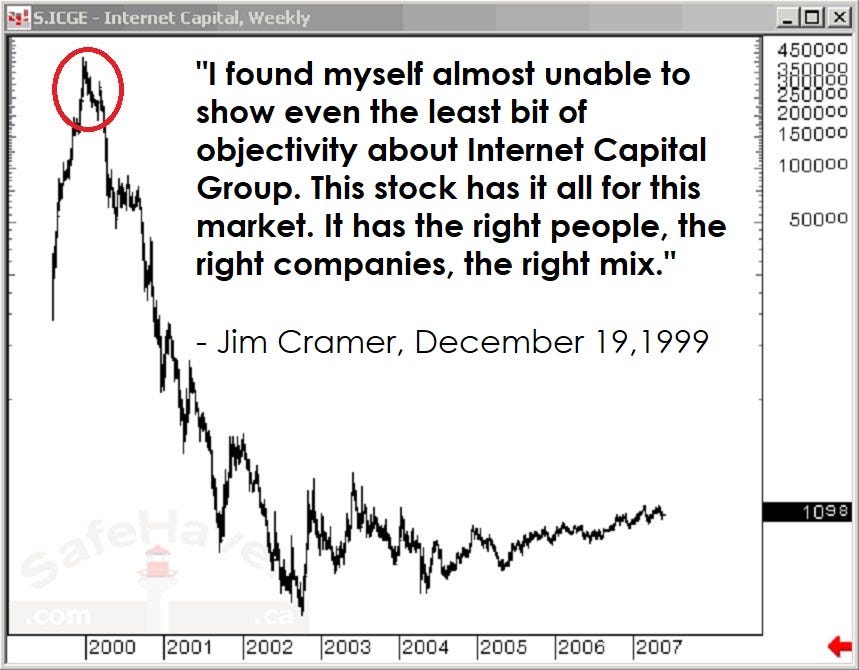

If you’re buying the index today, be fully aware of what you’re buying. I know it’s “low cost” but it’s a lot riskier than you are being led to believe. It’s feeling “exuberant” out there. I’m just not sure if it’s 1997 or 1999…

Source for image above: Rudy Havenstein. If you’re a skeptic when it comes to central banks and big government, and you like good music, check out his Substack.

Finally, file this one under “unintended consequences.”

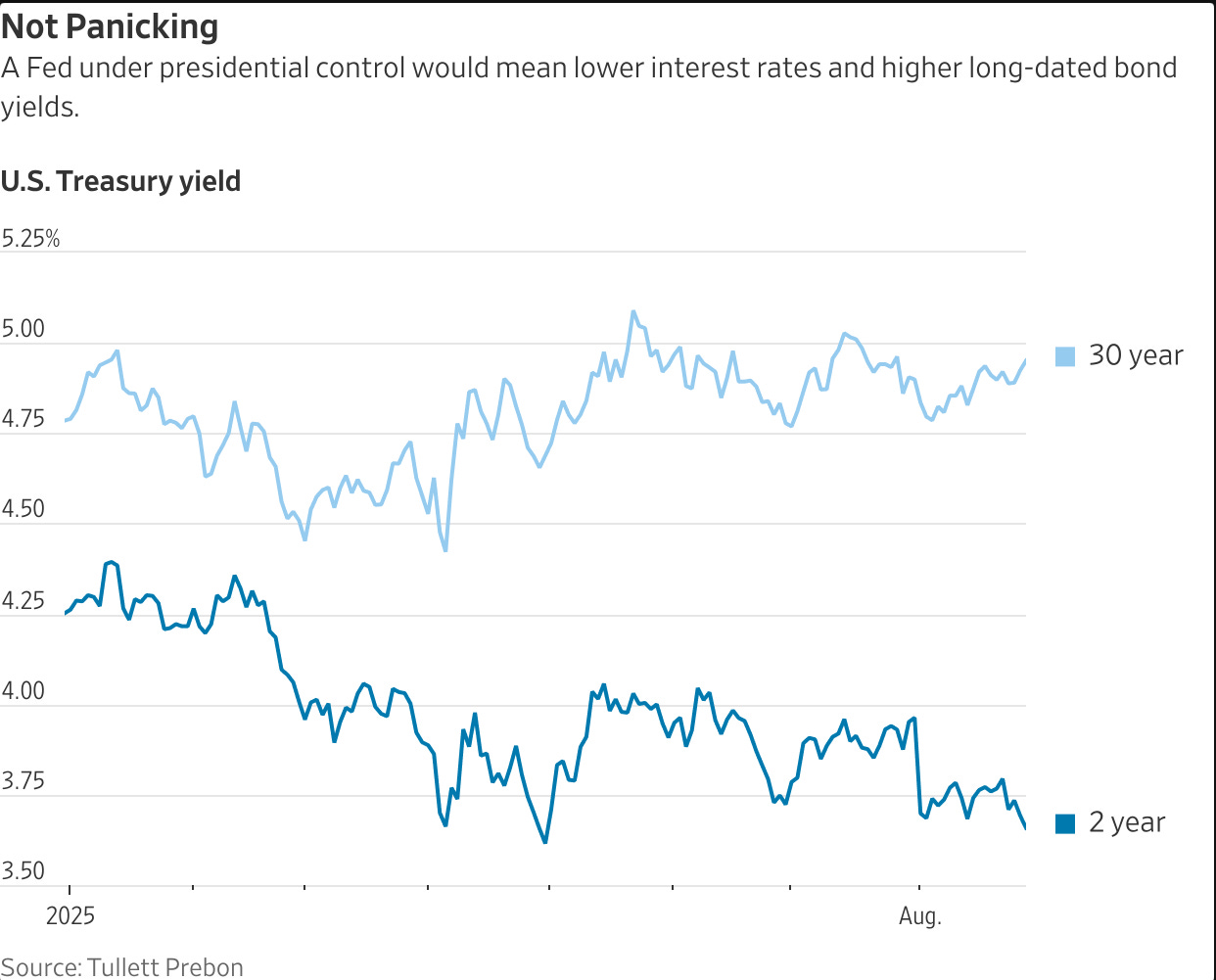

Will the US President’s efforts to reduce short-term interest rates actually work to increase inflation expectations, and as a consequence, lead to higher long-term interest rates? If so, might this be the catalyst that ends this cycle of speculation?

Stay safe out there!

Written from a distinctly Canadian angle - ever since our government legalized cannabis, a seemingly impossible number of local weed shops keep springing up. It seems to be the one thriving industry in an otherwise troubled economy, and nobody seems to know how there’s enough demand to support them all!

Seems reasonable to assume that the large companies' heightened capital intensity will normalize at a lower level over the next few years; yes, maybe higher than in years past, but quite a bit lower than today.

Good piece! I'd keep Morgan Housel's comment in mind, when he states that his best writing is when he writes for himself. This Checklist Series is worthwhile!