As simple as possible, but no simpler

There is danger in an oversimplified investment thesis

I’m on the record for saying that simplicity beats complexity, almost every time.

When evaluating a company as a potential investment, this can be a tricky balance. You can never know everything about a company. You have to know when to say that the information you have is good enough, and get on with making a decision. You will never have perfect information. After a certain point, I would argue that the more data points you look at, the worse a decision you end up making. Better to isolate the stuff that really matters (my Checklist Series walks through the factors that I think are most important).

And despite my preference for simplicity, it is possible to oversimplify. Perhaps the most egregious example of this is the use of the Price to Earnings ratio. In particular, I’m going to focus on the recently announced Nvidia earnings, because a favourite mantra of the bulls is that Nvidia is cheap on a P/E basis.

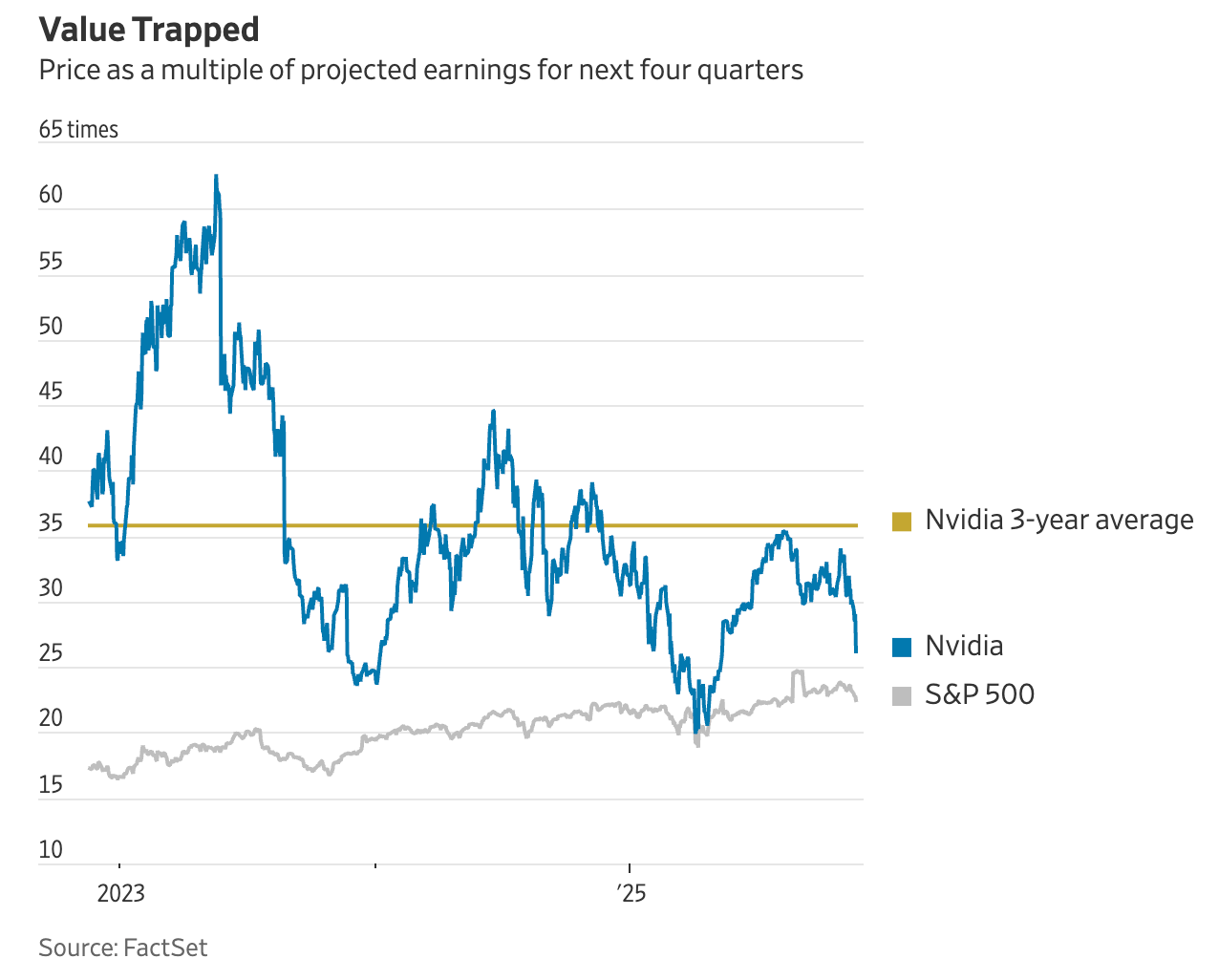

According to this WSJ article, Nvidia trades at just 26 times next year’s earnings. This is below its 3-year average. It also happens to be about what the Nasdaq is trading at right now.

This is objectively cheap for a company growing at Nvidia’s breathless pace, but you have to make some assumptions to come to that conclusion. In its most recent quarter, revenue was up 62% over last year, and net income was up 65%. Project this growth rate out for a few years and this stock is a damn bargain. I admit this is true! I heard this repeated ad nauseam all over CNBC and X, as analysts and investors took their victory laps.

The problem, of course, is that Nvidia operates in a notoriously volatile and cyclical industry. As recently as 2020, the company actually saw annual revenue shrink almost 7% from the prior year. Although tremendously profitable today, in ‘08 and ‘09, the company lost money. Take a look at the huge variance in earnings over a 20 year period ending in 2016 (and yes, I specifically chose this range, prior to the AI revolution, to emphasize the cyclicality of earnings).

Once the current growth cycle taps out, might this be reflective of the future that awaits Nvidia once again?

There is an aggressive land rush taking place right now that will almost surely result in overinvestment, and when the tide turns, demand for Nvidia’s chips may hit the proverbial brick wall, at least temporarily. And that won’t be kind to the company’s earnings (or stock price). Anyone who has ever run a business knows the challenge of building up capacity to meet surging demand, and the risk of that demand disappearing virtually overnight. And that’s in addition to all of the other reasons I recently wrote about detailing why high growth investments often disappoint.

The current growth rate will moderate, and it’s a question of when, not if. How do I know this? Because that’s what Nvidia’s customers are telling us! I’ll leave you with a few quotes. And then I want you to consider whether it makes sense to assess the value of this stock based on the single data point of price to next year’s expected earnings.

“There will be an overbuild of AI infrastructure”

Satya Nadella, Microsoft

“In the worst case, we would simply have pre-built for a couple of years, eating depreciation and eventually growing into the extra capacity.”

“If we end up misspending a couple of hundred billion dollars, I think that that is going to be very unfortunate, … But what I’d say is I actually think the risk is higher on the other side.”

Mark Zuckerberg, Meta

“Many data center projects are being built without clear customers in mind.”

Joe Tsai, Alibaba Group

“Given the potential of this technology, the excitement is very rational. It’s also true when we go through these investment cycles, there are moments we overshoot collectively as an industry.”

Sundar Pichai, Alphabet (Google)

I’m not saying that we are at the verge of collapse. In fact, I’m fielding so many calls and questions from investors worried about an imminent crash that the contrarian in me thinks there’s quite a bit of runway left for the bull market. But if we are building a low-risk portfolio, this isn’t a game we necessarily want to play. There are many companies with steady, more predictable businesses trading at relatively attractive multiples that it doesn’t make sense to play this higher risk game. I just wanted to share this note because the facile commentary about Nvidia shares being “cheap” based on forward earnings is quite dangerous, given the uncertainty of what is to come.

Thank you! There's so much drama surrounding NVDA and I appreciate your clear-headed approach here.