Your partner in hitting home runs

The stock market as your adversary

The main purpose of the stock market is to make fools of as many men as possible.

Bernard Baruch

What the casual observer often fails to understand is that stock prices in “the market” are not objective. They reflect the aggregate judgment of all market participants. And so if all of the news coverage you are reading is negative, chances are that this will already be reflected in investor outlooks, and so prices will be low. Any news that is “less bad” than most people expect will therefore actually result in higher prices. This means that, counterintuitively, the worse the news is, the better a time it is to invest. In that sense, saying “I’m optimistic, because how much worse can things be” is not just dark comedy but a viable investment strategy.

Conversely, when everyone is optimistic about the future, prices are probably as high as they’re going to get. A bright future is priced in, and so it will be hard for prices to continue to rise.

It’s counterintuitive, particularly for the businessperson who is often used to following trends of consumer behavior. If everyone is thrilled about a product, you make money by giving them more of it!

Being an investor requires you to change your thought process, and to become more of a contrarian. Rather than chasing trends, investors need to look for areas where consensus opinion is wrong.

And so one needs to assume an almost adversarial relationship with the markets, and with financial news. It’s important to develop an awareness that the news you are listening to is the exact same news that everyone else is also hearing. And so whether what you’re hearing is negative or positive, remember that it’s likely already reflected in market prices.

That the crowd is always wrong is an investment truism. The peaks of mania are times when everyone is loading up on margin debt and day trading. And the market usually finds a bottom just as everyone has given up hope and decided that prices will never rise again.

If this leads you to conclude that people are stupid, I’m not going to argue with you, just based on principle. But that’s the wrong conclusion to arrive at. The crowd isn’t wrong at market extremes because it’s stupid. The crowd is wrong at market extremes because that same crowd is setting the prices at which it’s buying and selling. If everyone is optimistic, prices are going to be too high. If everyone is pessimistic, prices will be too low. And so even if the crowd is right to be optimistic or pessimistic, once prices reflect that view, there’s no incremental money to be made. You’re just going along for the ride.

How to overcome this? Be comfortable buying and owning stuff that is out of fashion. The stock market is like a store that is constantly updating its prices to reflect worldwide demand for its products. The minute everyone decides they don’t like black shirts (Shows dog hair! Too hot to wear in the sun! Fades in the wash!), the price of black shirts will fall. Eventually, you should buy those black shirts because they will get so cheap that it won’t make sense to buy the pink shirts everyone else is wearing. Because, let’s face it, a black shirt hides your belly, and it looks best with a pair of blue jeans, and the world will eventually come around to realizing that.

Every good investor needs to keep this in mind—that market euphoria and panic are really working against you to force errors. And despite me saying that the market hates you, I’m certainly not suggesting that you avoid it; quite the opposite, I encourage you to embrace it.

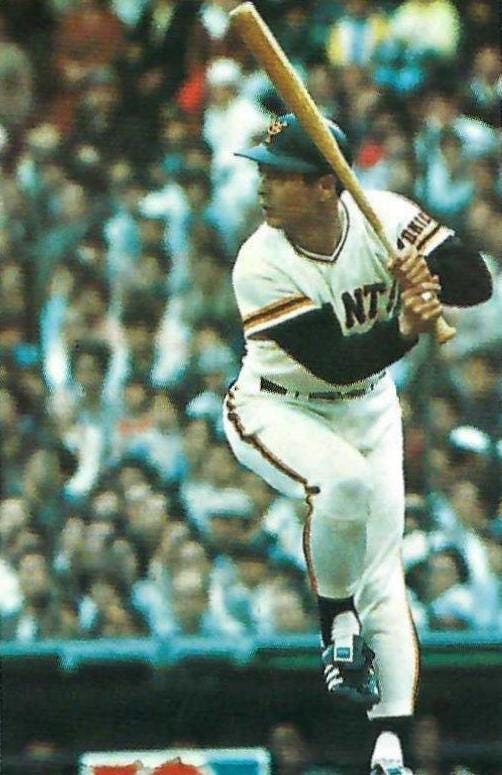

One of my favorite well-known quotes comes from the legendary Japanese slugger Sadaharu Oh, who said that he never saw the opposing pitcher as his adversary, but rather as his “partner in hitting home runs.”

Sadaharu Oh would never have become the legend that he is without those opposing pitchers.

You need to look at the stock market in the same way.

Always remember: it is trying to defeat and deceive you. It is not on your side. But you can use it as your partner to hit home runs. Your partner to build wealth… and stock up on black shirts when they’re on sale.

Great write up. One key point you write is the market is wrong at extremes. I think in general the market is right, but it’s identifying those extremes and taking advantage of them that are the big wins.