We're number two!

How consistency compounds

The third fiscal quarter of 2025 wrapped up a couple of weeks ago. For professional money managers, ‘tis the season for meeting with institutional clients and reviewing portfolio performance for the past arbitrary 3 month period.

And what an odd quarter Q3 was. The third chapter of a very odd year. Investors are simultaneously chasing growth and hoarding gold, uncertain of whether the next play is an Artificial Intelligence boom or economic collapse. The only common element seems to be a disregard for traditional valuation metrics. Us “old school” guys are looking a little bit silly.

For those of us evaluated on the basis of “relative” returns, it’s tough to keep up with the hot new thing from one quarter to the next. Inevitably, the dreaded underperformance must be faced.

Over time, consistently trailing the market is a bad thing… but when I say over time, I mean through multiple market cycles. In a momentum-driven market, I might actually want to see my fundamental manager trail the market. That’s a good thing if it means they are not holding risky investments in order to chase performance. The key, of course, is to dig deeper in order to understand the drivers of performance… both of the broader market, and of the manager being evaluated.

It’s hard to stay on top every year.

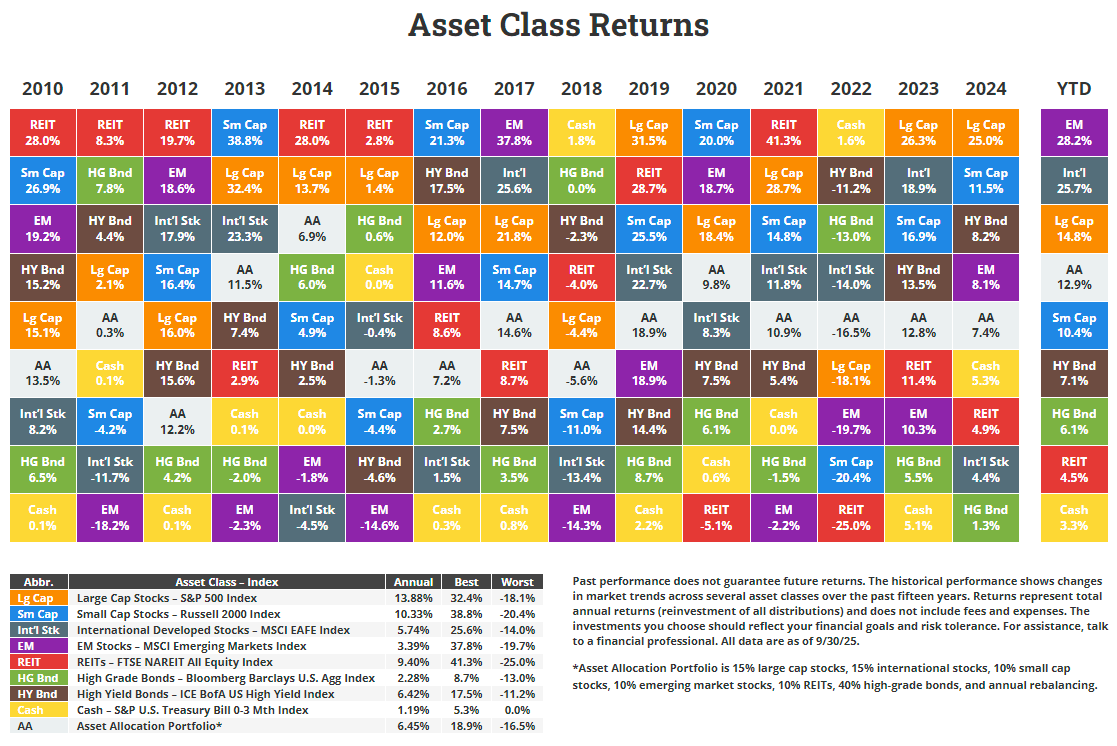

Take a look at this table, which you’ve probably seen a variation of before:

What this tells us is that a top-performing asset class in one year can easily be a terrible performer in the following year. But not always! Sometimes top performance can sustain for years (look at REITs from 2010 - 1015, for example).

The key, of course, is not to chase short-term performance. And not to evaluate your money managers based on one or two year numbers (or, heaven forbid, quarterly numbers!)

I recall a long-term-successful manager telling me, “My goal is to be second quartile each year. . . the top-ranked managers need to take too many risks to get there.” (To clarify the investment-speak, the second quartile manager would rank in the 25 to 50 percent best out of the universe of managers.)

Being a consistent second quartile manager won’t get you on CNBC, or on the Barron’s list of top advisors. Not this year. And not next year. But do this over business cycles and decades, and your clients will be very happy. Your long-term record will speak for itself. For a money manager, this is an admirable goal.

Over an investment lifetime, quiet consistency wins.