Things that don't change

Timeless advice for a manic market

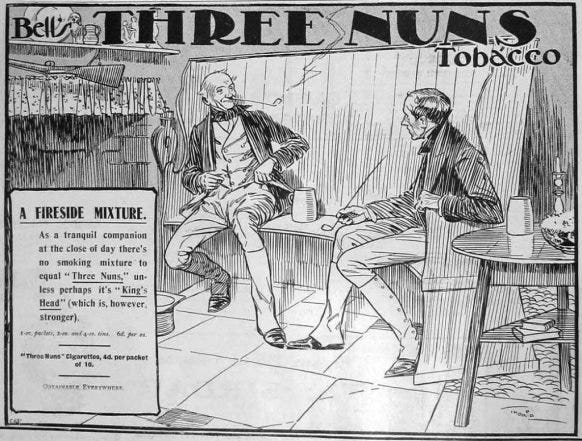

Here’s something you don’t hear every day. Recently, I decided to take up smoking. No, not cigarettes. And even though it’s 2023 and the “sweet leaf” is seemingly everywhere, not marijuana.

I decided to start smoking a pipe.

From the mid-20th century aesthetic of a man in a tidy suit and fedora smoking a skinny billiard, to Tolkienesque bearded Middle Earth characters puffing away, pipes conjure up images that are most certainly not of this time and place.

I took a bit of ribbing from friends and family over my new hobby. Seems to fit in with my “old man” aesthetic (and temperament). I’m not yelling at the kids to get off my lawn (yet).

It’s all a bit fussy. Pipe tobacco needs to be prepared. Sometimes a slice needs to be cut off a brick, or a bowlful dried out for a while before it’s ready to smoke. There’s a learning curve to packing it right, and that technique will vary based on the cut of the tobacco. The pipes themselves can be historical artifacts, demanding delicate care. Even cheapie beater pipes need to be regularly cleaned with a pipe cleaner and a tool to scrape off carbon that accumulates in the chamber.

It’s not modern in any way. It’s not convenient. It’s a bit dirty, and certainly stinky (I believe in a good way, but that’s up for debate). It can take a good hour to sit and enjoy a bowl, making it an activity that isn’t well suited to our fast-paced lives.

And frankly, that’s the point.

What does this have to do with investing? Am I just looking for an excuse to ramble on about my pipes? Maybe! But hear me out.

Driven by the financial media news cycle, investors are quick to dispose of the old and chase the latest fad. The past few years have been a whirlwind. We went from “software as a service,” to an impending Great Depression II, to “stay at home” technology stocks, to crypto, to big tech. For a brief period, the future was all about the “metaverse” and virtual reality. Blink and you missed it. Today it is all about Artificial Intelligence. This is a short summary of just the past 3 1/2 years. I do this for a living and my head is spinning. What chance do the rest of us have?

Chasing the hot new thing can be exhausting. It’s far easier to concentrate on making money in the things that don’t change. A portfolio made up of stalwart companies in areas like consumer staples, health care, and banking won’t set the world on fire, but over the long run is very likely to outperform the one jumping from one fad to the next.

In Low Risk Rules I quoted a study which showed that “theme” ETFs underperform the market by 3.1% per year after their introduction. This is some major underperformance, and it’s what happens when people try to catch a ride on the “next big thing.”

Beyond chasing fads, my decade in a family office put me in touch with many of the world’s wealthiest families. Many of them were eager to share their “dealflow” with us, and I didn’t do much to ingratiate myself to them, offering a series of “thanks, but no thanks” replies to their investment ideas. Complexity, illiquidity, and high fees were themes common to the investments on offer. Some of them were cool, no doubt (an NBA team and a music publishing partnership organized by one of my favourite bands, to give a couple of examples), but didn’t make sense when evaluated within a typical risk/return framework. I have always preferred a simple, long-only portfolio of publicly traded stocks and bonds, and my experience seeing how the ultra-wealthy built their portfolios only served to solidify my beliefs.

Inevitably, when I would have these discussions with others at conferences, I’d get a weak smile and a nod, kind of saying “well, isn’t that quaint.” I recall one memorable chat with a family office CIO who condescendingly told me that I just needed to properly “educate myself” on alternatives. I held my tongue, not mentioning that I was a CFA charterholder, and she was a rich kid managing her dad’s money. I still pat myself on the back for my restraint on that one.

My preferred investment style is seen as simple and behind the times. The crazy thing, though, is that it works. The famous Warren Buffett/Ted Seides bet tells that tale better than any other example I could give you (although you can find more in my book).

The things that don’t change are dependable. They are timeless for good reason. Investing like our grandparents might have - buying blue chip stocks and holding them forever - is the most sensible and reliable path to investment success that I have ever seen.

Back to my pipes for a moment. Dive deep enough into tobacco pipe geekery and you will encounter the meerschaum pipe. These unique pieces are carved out of a soft sepiolite rock (“meerschaum” is the German word for seafoam). Unused, they are a pristine white - like your brand new AirPods case. However, unlike the shiny new Apple product, these pipes are designed to get more beautiful over time, as their use reveals the grains and patterns inherent in the material itself, turning them a beautiful golden brown.

Like a compounding stock portfolio, this takes time and patience, evolving over years and decades. It’s not about chasing quick gains in cryptocurrencies or AI stocks, but rather a slow, steady approach. It works, and dare I say, it can be beautiful.

What a wonderful piece. This idea of investing in things that don't change is absurdly wise. In Terry Smith letters, I found he always mentions the average foundation date of companies, which, in some way, shows the endurance of their business models and industries.

Thank you for sharing, excellent article!