The gamblers keep winning

2024 in review

As we approach the decade’s halfway mark, we can reflect on what a wild ride it has been. It’s now been five years since rumours of a deadly virus in some Chinese city we had never heard of morphed into an unprecedented global crisis. In retrospect, this period will be remembered as one where lawmakers and central planners overreacted to risks, distorting behaviour and markets in ways that are still reverberating around the globe.

Unprecedented fiscal and monetary stimulus was poured out during the pandemic. Many sane people looked around and wondered where all the money came from. If governments can just “print” money and send out cheques to citizens for doing nothing, what value does that money actually have?

Separating money from the production required to earn it led to distortions in human behaviour. Consumer spending soared. So did financial speculation of all kinds - in stocks, real estate, and even make-believe assets like cryptocurrencies and non-fungible tokens (remember how NFT’s were supposed to be a revolution of modern finance and jpeg pictures of apes were being sold for millions?)

Following the 2022 stock and bond market rout, which some people (me included) believed to be a return to sanity, the financial speculation ramped up again in 2023, and if anything, has only gained steam in 2024. Is the stock market as expensive as it was in 1999? Not really. But if you sub in the value of crypto assets (now approaching $3.5 TRILLION), for profitless “dot coms,” it kind of is.

Combine this with a boom in sports gambling, and it’s clear that we have a population that is hell-bent on making fast, easy money.

The question we have to ask ourselves is whether we are in the early or late stages of this mania. It could be 1999, with the clock soon ticking midnight at Cinderella’s ball. But maybe not. Don’t forget, it was in December of 1996 that Fed Chairman Alan Greenspan first used the term “irrational exuberance” to describe the bubble mentality taking over Wall Street. History has proven him right, but anyone who used his proclamation as an excuse to sell stocks missed out on another 3-plus years of huge gains.

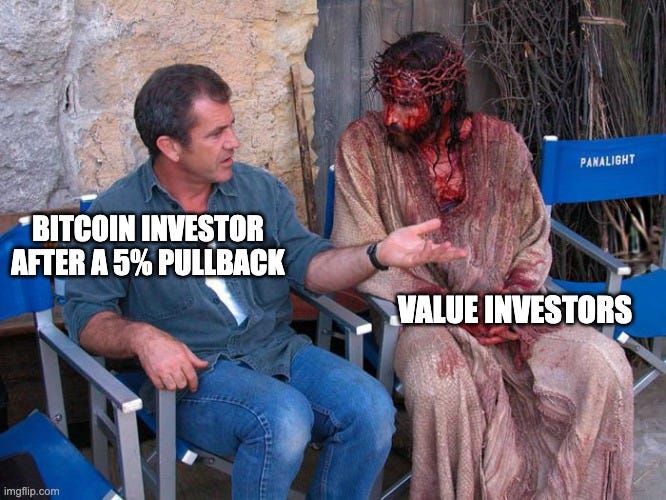

Your fundamental, value oriented manager most likely underperformed this year, for the sin of not owning Nvidia and enough of the other “Magnificent 7” stocks that led the market higher this year. They probably still did really well on an absolute return basis, but a lot of their clients are probably asking why they trailed the S&P 500, yet again. Take it easy on them, it’s been a rough decade.

Sanity, like gravity, will return. We just don’t know when. Often, turning the page on a calendar provides a reset that prompts investors to question the assumptions they carried with them into the new year. Most people reflecting on the year that just passed are fully aware of the speculative mania gripping markets. What’s uncertain is whether they conclude that it’s time to cash in some chips, or try to make as much easy money as possible before the music stops.