The Winners of the New World, Redux

The lessons of history

When I was growing up my sister loved the show Full House. The syndicated reruns were a constant presence in our house. It must be said that back in those days, it wasn’t available via streaming on demand, but rather on broadcast TV, starting conveniently at the top of the hour.

Each episode of the show ends with some sappy music and a lesson that’s learned by one or more of the show’s protagonists. What I came to notice over time is that the sappy music kicked in at precisely 24 minutes past the hour. I noted it once or twice, and then it became a running joke. At 23 minutes past the hour, I would announce that the sappy music was incoming. My sister would tell me to shut up, she’s trying to watch the show. And then one minute later, as the music inevitably swelled, I would laugh and claim credit for spotting the repeated pattern.

This would allow me to partake in two of my favourite things at once: being right, and making fun of stupid things. Conveniently, it also annoyed my sister.

The moral of the story: patterns repeat.

Which brings me to the market.

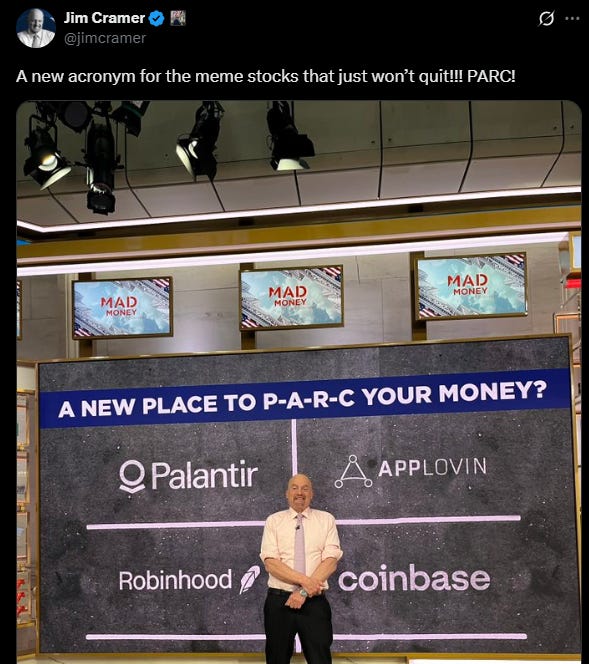

Earlier this week, Jim Cramer confidently announced that these four companies, with an average price to sales ratio of around 45x, were a great place to “park” your money.

After I stopped laughing at the insanity of this (and the fact that the letters in “PARC” could be rearranged to spell “CRAP”), I instantly recalled a column the same man wrote for TheStreet.com back in 2020, on February 29, just a week or so before the Nasdaq topped. The Winners of the New World” remains a legendary example of bad timing and bad advice.

In retrospect, it’s a tremendous display of the folly and hubris we see at market tops, and always worth revisiting.

If you haven’t read it before, strap yourself in. This is a good one!

Who were the “winners of the new world”? That’s incidental to the story, but in case you’re wondering, they were 724 Solutions, Ariba, Digital Island, Exodus, InfoSpace.com, Inktomi, Mercury Interactive, Sonera, VeriSign, and Veritas Software.

Nope, not an Apple, Microsoft, Nvidia, or Amazon in sight.

In Cramer’s own words:

We are buying some of every one of these this morning as I give this speech. We buy them every day, particularly if they are down, which, no surprise given what they do, is very rare. And we will keep doing so until this period is over -- and it is very far from ending. Heck, people are just learning these stories on Wall Street, and the more they come to learn, the more they love and own! Most of these companies don't even have earnings per share, so we won't have to be constrained by that methodology for quarters to come.

No need to worry about those pesky earnings! Just buy them every day!

What do they do? Well let Cramer tell you!

They all do the same thing: They make the Web faster, cheaper, better and easier to access anywhere, anytime. They allow you to get on the Web securely anywhere in the world. They make the Web economy the only economy that matters. That's all they do.

Written just like somebody who has no idea what these companies actually do.

Back then, it was all about “The Web” and “The Net.” Yes, everyone was right about how big an impact the internet would have on our businesses and our lives. In fact, the extent to which this technology would change our lives was arguably understated and misunderstood. Just like we might be doing today with Artificial Intelligence. But that doesn’t mean it was easy to make money gambling investing in the field.

We try to own every one of them. Every single one. And if I had my druthers, I wouldn't own any other stocks in the year 2000. Because these are the only ones worth owning right now in this extremely difficult, extremely narrow stock market. They are the only ones that are going higher consistently in good days and bad. I love every one of them, just as I loathe the rest of the stock universe.

Why own anything else?

How did this stock market get like this, to where the only people who can make a dime in it are the people who are interested in the most arcane subject, the moving of data from one space to another, via strange new machines and software? How did it get to the point where nothing else matters, most particularly the 90% of the stock market I have studied for the last 20 years? How did all of that knowledge become totally irrelevant and the only stocks that work are the stocks of companies that didn't exist five years ago and came public in the last two or three years?

How much does this sound like the crypto evangelist explaining how the blockchain will upend modern finance? Or the analyst telling you that Nvidia can’t lose in the new AI driven economy? Nothing else matters!

Yeah, forget about the old way of doing things, this is the new economy….

How did this bizarro world where nine-tenths of the companies I have followed as a stock picker for the last 20 years are losers and one-tenth are winners? To answer that question, you have to throw out all of the matrices and formulas and texts that existed before the Web. You have to throw them away because they can't make money for you anymore, and that is all that matters. We don't use price-to-earnings multiples anymore at Cramer Berkowitz. If we talk about price-to-book, we have already gone astray. If we use any of what Graham and Dodd teach us, we wouldn't have a dime under management.

With the benefit of hindsight, we now know that the game wasn’t “very far from ending,” as Cramer wrote. In fact, it was the bottom of the 9th with 2 outs and 2 strikes. A legendary multi-year bull market was just days away from ending.

Unfortunately, the current bull market doesn’t come with a clock. I’m not sure if it’s 23 minutes past the hour and the sappy Full House music is about to play us off with some hugs and tears and a lesson to all of the speculators that making money in the market isn’t supposed to be easy. There might still be a few minutes left to go. For all I know, we might still be a couple of commercial breaks away from the final scene. But I can tell that we’re getting closer and closer to the top every single day.

Some hard lessons will eventually be learned, and Uncle Jesse won’t be there to offer a hug to make it all better. Be careful out there.