Picture this investment anomaly

This isn't supposed to be true.

The cornerstone of Low Risk Rules is the idea that you can actually earn higher investment returns over time by taking less risk.

This can’t be right, can it? I mean, everyone knows that risk and return go hand in hand. And generally speaking, they’re right. Equities, as a broad asset class, earn more than bonds. This is how investors are compensated for taking additional risk.

While this investment truism holds between asset classes, it doesn’t hold up within asset classes. We have known this for over 50 years now, and yet our investment textbooks still cling to the idea that risk and return are positively correlated.

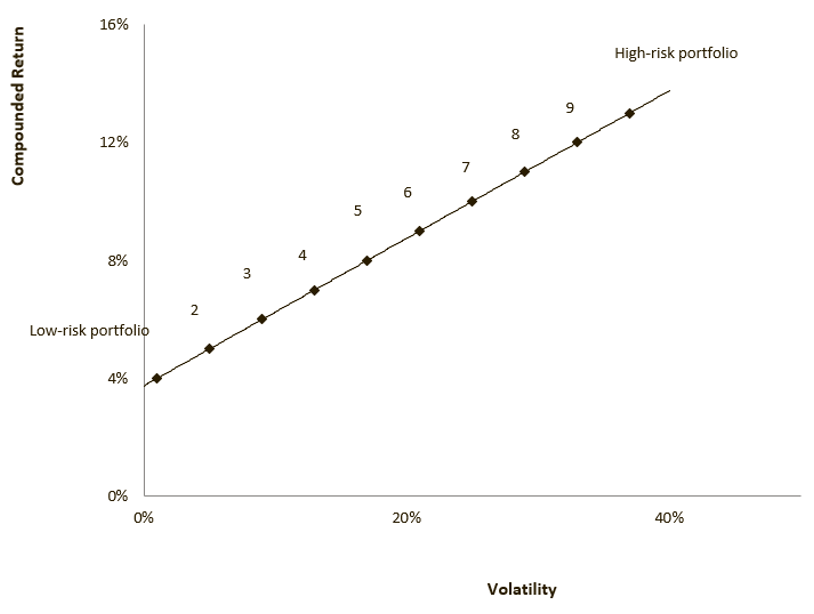

This is the picture you’ll be presented with in your introductory finance course. Risk (as measured by volatility) is on the horizontal axis; return is on the vertical axis.

The story this chart tells us is very simple - as your “risk” increases, so does your expected return.

All of modern finance theory is based on this idea.

It’s very neat and simple.

It’s also wrong.

The historical data in the stock market actually looks like this:

There is no evidence that moving up the risk curve will guarantee you a higher return… in fact, investors with the highest risk portfolios have historically ended up with the worst results over time. The data is here if you’d like to take a closer look (all credit to Pim van Vliet for his outstanding research and for continuing to maintain this website and keep the data set updated).

If you’d like a bit more background on the history of the research supporting the low risk anomaly, you can find it in Chapter 17 of Low Risk Rules, which is available free if you subscribe to this newsletter (also free).

Despite the historical data, we are in an era where the opposite has been true - aside from a brief interruption in 2022, the higher risk portfolio has outperformed the lower risk portfolio for much of the past decade. A gamble on the continuation of this trend goes against nearly a century of market history.

We don’t know when the tide will turn, but as sure as gravity exists, it will turn at some point.

Surprisingly, I have found that many investment professionals are not familiar with the research surrounding the low risk anomaly. This is wild to me. In my opinion, it’s the single most important investment “factor” we can incorporate into our portfolios - not only to earn the highest possible risk-adjusted returns, but also to protect portfolios from huge losses when this growth and momentum era ends.

We have never seen an environment with so many investment dollars being funnelled into fewer and fewer stocks as we see today.

To put it simply - this isn’t sustainable.

I’m hoping that writing about this raises awareness for a strategy that promises to outperform when the current trend exhausts itself.

Please help spread the word. The long-term investment success of countless families and institutions hangs in the balance.

As always, thanks for reading and sharing.