“Lying a little bit to make the money come in”

Take my money and lie to me, postscript

I’ve written recently on the difference between public and private investment valuation, and how the lack of a daily mark to market “smoothes” returns on unlisted investments. None of this is terribly controversial (unless you make a living managing or selling private funds). And yet, I’ve received a lot of comments (all friendly) from people in the space or advisors who have their clients invested in these funds claiming that I’m overstating the risks.

To clarify, I’m not saying that all private funds are going to collapse. I’m just saying that they’re a lot more risky than their marks to market let on, and that makes it very difficult for clients to distinguish between those that carry more or less risk. Even in something as low risk as residential rentals, I’m seeing private funds maintaining or increasing their NAVs, while equivalent public REITs have declined markedly. The truth, as far as valuations go, probably lies somewhere between the two extremes.

If you’re an investment professional or a student of the craft, you understand this. But most clients are in the dark. I’m talking to the investor who may not be aware of how these funds are hiding volatility (and potentially, the risk of permanent loss of capital). So I hope you don’t mind if I beat this dead horse just a bit more. Because if you allow them to, private investment funds can hide a multitude of sins.

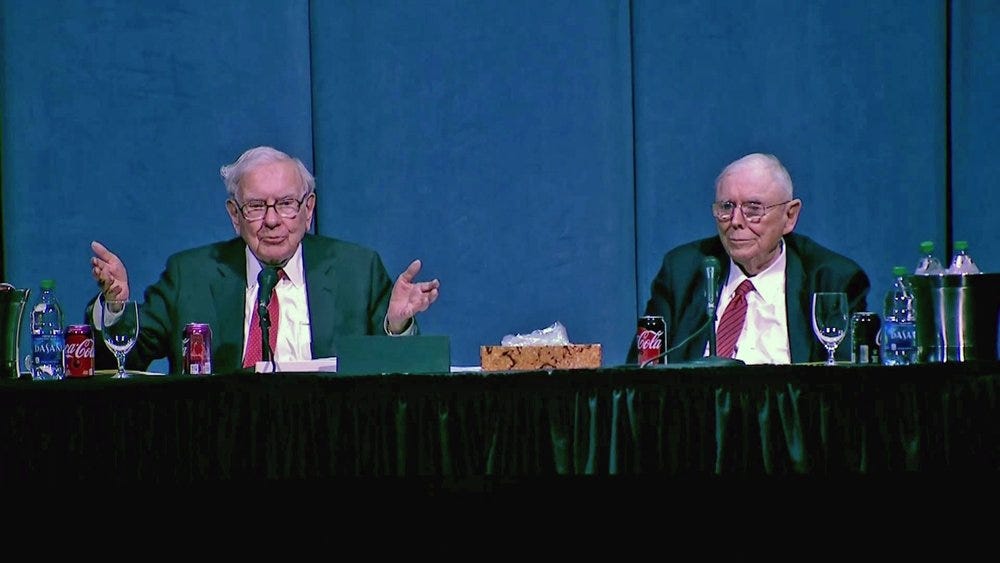

Warren and Charlie tell it like it is

At the 2019 Berkshire Hathaway Annual Meeting, Warren and Charlie received a question from a pension manager specializing in alternative investments. This cue was a prompt for a great discussion highlighting so much that’s wrong with the asset class (much of which I’ve already covered here and in Low Risk Rules).

Dubious marks to market? Check.

High fees? Check.

Locking up investor funds? Check.

The challenges of managing liquidity in order to meet capital calls? Check.

Since they are both much smarter and more articulate than me (and frankly I’ve always admired Charlie Munger’s ability to summarize a situation in the most blunt terms possible), I thought I’d paste some of the discussion here (I’ve edited out the parts that are not relevant to private client or family office investing).

I aspire to reach a point in my life and career where I can tell it like it is the way Charlie does - dropping truth bombs and not caring who gets offended. Stick around. You’re going to love this newsletter when I’m 99 years old.

WARREN BUFFETT: “…we have seen a number of proposals from private equity funds, where the returns are really not calculated in a manner than — well, they’re not calculated in a manner that I would regard as honest.

And so I — it’s not something… I would be very careful about what was being offered to me.

If you can raise $10 billion in a fund, and you get a 1 1/2 percent fee, and you lock people up for ten years, you know, you and your children and your grandchildren will never have to do a thing, if you are the dumbest investor in the world. But —

Charlie?

CHARLIE MUNGER: Well, I think what we’re doing will work more safely than what he’s doing… but I wish him well.

WARREN: if you run a fund, and you get even 1 percent of a billion, you’re getting $10 million a year coming in. And if you’ve got the money locked up for a long time, it’s a very one-sided deal.

And you know, I’ve told the story of asking the guy one time, in the past, “How in the world can you — why in the world can you ask for 2-and-20 when you really haven’t got any kind of evidence that you are going to do better with the money than you do in an index fund?” And he said, “Well, that’s because I can’t get 3-and-30,” you know. (Laughter)

CHARLIE: What I don’t like about a lot of the pension fund investments is I think they like it because they don’t have to mark it down as much as it should be in the middle of the panics. I think that’s a silly reason to buy something. Because you’re given leniency in marking it down.

WARREN: Yeah. And when you commit the money — in the case of private equity often — you — they don’t take the money, but you pay a fee on the money that you’ve committed. And of course, you really have to have that money to come up with at any time. And of course, it makes their return look better, if you sit there for a long time in Treasury bills, which you have to hold, because they can call you up and demand the money, and they don’t count that. They count it in terms of getting a fee on it. But they don’t count it in terms of what the so-called internal rate of return is. It’s not as good as it looks. And I really do think that when you have a group sitting as a state pension fund

CHARLIE: Warren, all they’re doing is lying a little bit to make the money come in.

WARREN BUFFETT: Yeah. Yeah, well, that sums it up.