Explaining my crypto JOMO

Why I'm having fun staying poor

Reality is that which, when you stop believing in it, doesn’t go away.

— Philip K. Dick

The “dollar debasement” trade is all the rage. Precious metals and cryptocurrencies have hit record highs this year based on the theory that out of control government spending and central bank dovishness will continue to erode the purchasing power of the dollar (or Pound, or Euro, or Yen… pick your fiat).

I actually agree wholeheartedly with this theory. In fact, it’s one of the reasons why I believe so strongly in an equity-oriented investment strategy, and why I believe there is hidden risk in “safe” fixed income investments.

So shouldn’t I be selling equities and stocking up on gold and Bitcoin? Why do I prefer owning stocks as a way to preserve my long-term purchasing power?

Munger would remind us to “invert, always invert.” And so I’ll devote today’s letter to explaining why I’m not buying Bitcoin (the “lowest risk” entry into the crypto universe).

I’m trying not to turn this into an “old man yells at cloud” blog, but I have to be true to myself, and the fact is that I’ll be eligible for the seniors’ discount before I know it.

In Low Risk Rules I wrote:

I want you to look forward to missing out on this year’s hot stock, or the startup all your friends are invested in, or the cryptocurrency you don’t really understand.

So, first things first - most people I talk to don’t understand bitcoin, or any crypto for that matter. That hasn’t stopped many from jumping on the bandwagon, and actually making money (at least temporarily) from doing so.

But what about those who do understand it? And I count myself in that group. Very early in the Bitcoin story — back in the mid-2010’s — I spent a few hours at a conference learning all about blockchain technology and cryptocurrencies. I’ve done a ton of reading about it since then. I get the technology, and I get the story. As someone who understands and supports conservative fiscal policy and various libertarian economic views, I should be a natural laser-eyed Bitcoin maximalist. But I’m not. How come?

It’s just a risk asset

Despite claims that it’s “digital gold,” Bitcoin has a higher correlation to the Nasdaq than it does to precious metals or other “risk off” assets.

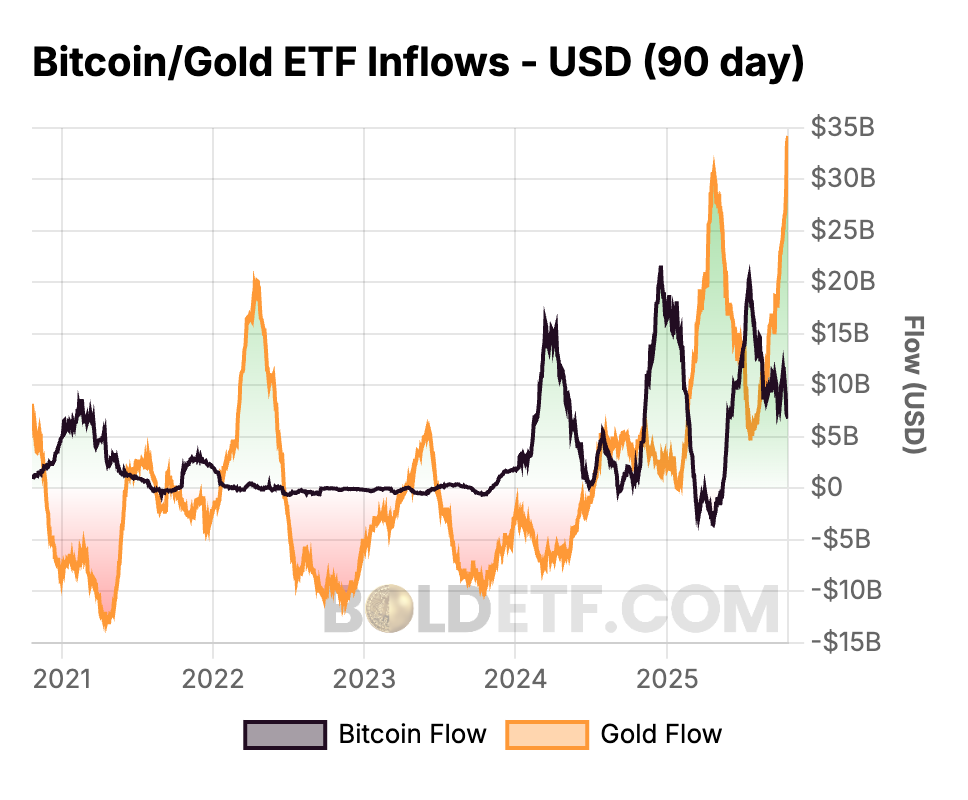

In fact, it not only moves opposite to gold, but investors treat it differently than they do gold, as demonstrated in the chart below.

It really is kinda the perfect vehicle for speculation. Maybe that’s all it is?

Where’s the cash flow?

An asset that relies entirely on value appreciation to generate returns is harder to value. The textbook value of an asset is the present value of future cash flows, and so it’s a lot harder to value an asset with no cash flows. Look at the historic volatility of gold as an example. If Bitcoin is indeed digital gold, expect similar booms and busts, which play out over decades… not years. Making this a really tough asset to hold through the downdrafts.

Reflexivity is a bitch

I think that Bitcoin is a type of Veblen investment (that is, an asset for which demand increases as price increases).

Two reasons for this:

1: there’s no reason to own it if it’s not going up, and so the more it goes up, the more people want to buy it; and

2: the longer it goes up in price and stays up in price, the more legitimacy it gains, leading to adoption by more investors, leading to further increased demand.

This is great on the way up. But not so great on the way down. A negative feedback loop of falling prices leading to more selling means that there is no reasonable way to put a floor price on the asset. This is reflexivity in action.

This, combined with the lack of cash flows to provide a valuation floor, make Bitcoin a uniquely risky asset.

It also means that in the event of a multi-year or decade-long bear market (which we haven’t seen yet, but which gold has seen several times), investors will bail. Unlike gold, which has a multi-millennia history of wealth storage, Bitcoin may be usurped by other options in the future if it goes through a prolonged downturn.

The treasury company conundrum

First it was MicroStrategy, which was quickly followed by a whole host of other “bitcoin treasury” companies, incorporated for the sole purpose of holding Bitcoin. Punters were willing to pay more for the shares of these companies than the value of the underlying bitcoin… until they weren’t. As this trade unravels, and these companies go from buying Bitcoin to selling Bitcoin, the reflexivity I talked about above will be fuelled by liquidating treasury companies. And I haven’t even mentioned MicroStrategy’s debt financing. You don’t want to be in the way of this selling!

Crypto’s deal with the devil

Trump is the Crypto President! This has been great for the crypto industry over the past year. And great for Trump family wealth.

Politicization of an asset class is a risk, especially one that relies on regulation to the extent that crypto does. I feel like a future Democrat administration might take pleasure in attacking Eric and Don Jr.’s crypto businesses. In such an event, don’t think Bitcoin will escape unscathed.

The Quantum computing problem

Could a future quantum computer hack the blockchain? I’m told… probably, yes!

But at that point we will also need to worry about that same computer hacking our bank accounts. Maybe our brokerage accounts too? My kids insist it’s not them cranking up the heat on a warm fall day. Perhaps a quantum computer has hacked my thermostat?

I’m going to assume that the powers that be will ensure that our bank accounts will not be emptied out, only because everyone has a bank account. Maybe this is naive. But you can’t say the same about Bitcoin ownership. If tomorrow we woke up and everyone’s Bitcoin was gone, most people simply wouldn’t care. “Oh well, that’s the risk you assumed when you bought it.”

Look man, I don’t pretend to know how this all ends. I just know that there’s a nonzero chance that some wicked fast computer from the future could wipe out my “investment.” Sorry. That’s enough for me to avoid.

Everyday, ordinary hackers

This is just one example. I follow Eric Falkenstein because he has written some hugely influential papers on the low volatility anomaly. Mr. Falkenstein is a genius. He is also a big crypto guy. Oh, and earlier this year, he got hacked. Not for the first time.

To his credit, he takes full responsibility. But I’d easily put him in the top 1% of the population in terms of intelligence. There is no hope for the rest of us.

Now multiply this by the number of people who don’t have a public platform, or who are too embarrassed to admit they got scammed or hacked. Or stupid people, like me, who forget their bank card PINs at least once a year. Nah man, I don’t need an extra thing to worry about.

My own doubt

Even if there was an answer to all of the above (and to Bitcoin holders, there are), I still couldn’t buy it. Why? For me, it comes down to my own conviction. I can't buy Bitcoin because I don't believe in it... period. For example, I'm not buying Palantir stock because I think it’s overvalued. I know that I could be wrong (I have been so far). I don't begrudge people making money on it and I don't mind being wrong on my call. It's just not for me. I don't have to own every asset that goes up.

In Low Risk Rules I write about the importance of having conviction in an investment. I don't have conviction in bitcoin - therefore, I shouldn't buy it. The price volatility makes it impossible for me to hold, because the next time it has a significant drawdown, I will be tempted to sell it. I’m not going to participate in that, because I know that I’m setting myself up for failure.

If you have that conviction, then great! You’ve done really well and I hope you continue to do well. I don’t have to be right about any of this. I only have to know that I’m confident that these are my views and my opinions, and based on that, this is a game I’m not going to play.

Going back to the quote that opened up this piece… I don’t want to depend on the opinions of others to validate the value of the assets I own. I’d prefer to root my portfolio in reality. I don’t think that crypto assets do that.

I’ve missed out on gains. I may miss out on more. I don’t care. That’s the Joy Of Missing Out!